The Best Strategy To Use For Sr-22 Car Insurance Basics

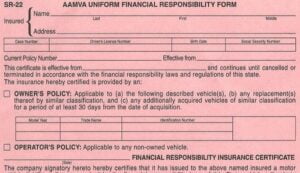

An SR-22 is not a real "type" of insurance coverage, but a form submitted with your state. This type serves as evidence your vehicle insurance plan meets the minimal responsibility insurance coverage called for by state law.

Do I require an SR-22/ FR-44?: DUI sentences Careless driving Accidents created by uninsured chauffeurs If you need an SR-22/ FR-44, the courts or your state Motor Lorry Department will notify you.

Present Customers can call our Customer care Department at ( 877) 206-0215. We will certainly evaluate the coverages on your policy and also begin the procedure of filing the certificate on your behalf (driver's license). Is there a fee connected with an SR-22/ FR-44? The majority of states bill a flat cost, but others need a surcharge. This is an one-time fee you have to pay when we submit the SR-22/ FR-44.

A filing charge is charged for each and every individual SR-22/ FR-44 we submit. If your partner is on your policy and both of you need an SR-22/ FR-44, after that the declaring cost will certainly be charged two times. Please note: The cost is not included in the rate quote because the declaring fee can vary.

Your SR-22/ FR-44 needs to be legitimate as long as your insurance coverage plan is energetic. If your insurance plan is canceled while you're still required to bring an SR-22/ FR-44, we are needed to notify the appropriate state authorities.

The Ultimate Guide To What Is Sr22 Insurance? - Student Advice - Collegian.psu.edu

You'll pay greater vehicle insurance policy premiums than a motorist with a clean document as well as you'll be limited in your selection of insurance companies. See what you might save on automobile insurance policy, Quickly compare customized prices to see exactly how much changing car insurance policy might conserve you.

You may be called for to have an SR-22 if: You've been convicted of drunk driving, dui or one more severe moving offense. You have actually caused a mishap while driving without insurance. You've obtained way too many web traffic tickets in a brief time, such as 3 or more speeding tickets within six months. You really did not pay court-ordered child support.

Not all states require an SR-22 or FR-44 (credit score). If you require one, you'll locate out from your state department of electric motor cars or website traffic court.

sr-22 insurance sr22 insurance insurance insure insurance group

sr-22 insurance sr22 insurance insurance insure insurance group

When you're alerted you require an SR-22, begin by contacting your vehicle insurance provider. Some insurance providers don't provide this service, so you may require to buy a firm that does. If you don't currently have vehicle insurance policy, you'll most likely require to buy a plan so as to get your driving privileges recovered.

Just how much higher relies on where you live as well as what violation resulted in your SR-22. Insurance quotes will likewise differ depending upon what automobile insurance business you select. To get the most effective rate for you, it's vital to compare prices from multiple insurance providers. See what you could conserve on vehicle insurance, Quickly compare customized prices to see just how much switching vehicle insurance policy can save you.

How What Is An Sr-22 Filing? - The Truth About Insurance.com can Save You Time, Stress, and Money.

Area issues. As an instance, consider a driver with a current DUI, a violation that could result in an SR-22 requirement. Geek, Wallet's 2021 rate analysis discovered that out of the country's four largest firms that all file an SR-22, insurance prices typically were most affordable from Progressive for 40-year-old drivers with a current drunk driving.

When your demand ends, the SR-22 doesn't instantly fall off your insurance coverage policy. Make sure to allow your insurance policy firm understand you no longer require it.

Rates typically remain high for 3 to five years after you've triggered an accident or had a moving offense. If you search following the three- and also five-year marks, you may discover lower premiums - insurance coverage.

Which states call for SR-22s? Each state has its very own SR-22 protection requirements for motorists, as well as all are subject to change. Contact your insurance provider to discover your state's present requirements as well as see to it you have sufficient protection (insurance group). For how long do you require an SR-22? The majority of states need motorists to have an SR-22to confirm they have insurancefor regarding 3 years.

An SR-22 is a certification of economic responsibility that is mandated by the state and also supplied by your auto insurance carrier, which specifies that your needed auto insurance policy holds - division of motor vehicles. An SR-22 certificate may be called for after a DUI arrest and/or sentence as a requirement to restore any type of driving opportunities.

Everything about Sr22 Certificate (Proof Of Insurance/financial Responsibility)

The real filing of an SR-22 expenses around $25 in many states. Your auto insurance premium may also increase considerably - motor vehicle safety. The need for an SR-22 certification tells the insurance firm that you are taken into consideration a risky chauffeur and high-risk chauffeurs typically need non-standard insurance policy policies., and the price is typically higher for several years until the vehicle driver has had a clean driving document.

If a motorist is convicted of driving without a permit and/or insurance coverage, the SR-22 certification might be needed for 3 years. A DUI apprehension and/or sentence can mandate SR-22 certificates up to the life of the chauffeur, depending upon the number of previous DUI convictions. State laws might call for motorists that do not own cars to obtain and keep a non-owner SR-22 certification to be qualified for driving advantages.

Ever question what is an Sr22? While Sr-22 insurance coverage isn't always a type of insurance coverage people want by option, it is a demand by many states to verify that a specific person has a particular level of vehicle insurance. Typically, it is called for by a court or court after a person has a mishap or gets a DUI and also doesn't have the bare minimum of legitimately needed insurance coverage at the time.

deductibles insurance ignition interlock sr22 insurance sr22 coverage

deductibles insurance ignition interlock sr22 insurance sr22 coverage

What is Sr22 Automobile Insurance Coverage? Some insurance coverage carriers do refer to their SR-22 automobile insurance policy plans as "high risk insurance policy" for vehicle drivers who have had severe crashes with victims or a history of driving intoxicated - insurance. Sr22 insurance protection take care of the fact that the party buying it is a high risk customer and often cares for showing to the state that they are now properly guaranteed as well as able to get on with driving once again.

division of motor vehicles dui car insurance department of motor vehicles division of motor vehicles

division of motor vehicles dui car insurance department of motor vehicles division of motor vehicles

Not to appear judgmental however after such habits, your standing as an SR-22 car insurance customer means you are basically an undesirable component with lots of insurance carriers. Not all insurer will cover SR-22 insurance customers. What Sr22 Insurance Policy Does Now, everybody is entitled to a 2nd chance to redeem himself or herself as well as getting SR-22 insurance policy coverage is the initial step towards doing that in the eyes of your carrier as well as the legislation.

The smart Trick of Sr22 Insurance That Nobody is Discussing

Is Sr22 Insurance Forever? After a few years of no mishaps or other severe driving offenses, the majority of people will no more require to file SR-22 forms to their state to prove that they are guaranteed and also will no much longer have to pay the greater costs that are normally connected with Sr22 insurance policy coverage (auto insurance).

Do not consider the restrictive nature of SR-22 auto insurance coverage as something you will have to live with permanently (sr-22). Having at the very least some form of obligation vehicle insurance policy coverage is called for by most states as well as if you have been associated with some kind of crash of event where you really did not have any type of automobile insurance policy, you will certainly need to explore buying SR-22 vehicle insurance policy coverage due to the fact that it will automatically file a type with your state proving that you are covered.

sr-22 no-fault insurance coverage underinsured car insurance

sr-22 no-fault insurance coverage underinsured car insurance

This is, obviously, very severe and also not something that must be overlooked. Driving is an opportunity as well as not a right and component of having that benefit entails being correctly insured. Buying SR-22 auto insurance policy will insure that you will certainly have the ability to delight in that benefit for years to find regardless of what has actually happened in the past.

Some people need to file an SR-22 insurance type after certain kinds of driving offenses (vehicle insurance). It's not a need for everyone. If you have actually listened to the term SR-22 insurance policy and are questioning what it is and also if you require it, below's what you require to know. SR-22 isn't insurance policy. It's a type your insurance provider files on your part that shows you have the minimum quantity of Have a peek here obligation coverage your state needs.

However not everybody that has a license requires to file an SR-22 (motor vehicle safety). Usually, a court or the state only calls for individuals that have serious driving violations, such as negligent driving or a DRUNK DRIVING, to submit the kind. If you have a put on hold license, your insurance policy business might require to submit an SR-22 form on your part before the state renews it.

Facts About Sr22 Insurance In Salt Lake City Utah Uncovered

If a court or the state needs you to submit an SR-22 or FR-44 kind, your insurance coverage carrier will certainly submit it on your behalf. You can't obtain one without insurance. However not all insurer submit these forms for their insurance holders. If your current insurance provider doesn't file them and you're needed to have one, you'll require to get a new policy (bureau of motor vehicles).

Some insurance business may submit an SR-22 or FR-44 for complimentary, while others might charge a filing charge. The filing charge usually varies from $15 to $50, depending on the insurance company and where you live. coverage.

According to The Zebra, rates might raise from concerning $350 to greater than $1,200 each year, depending upon the offense. In basic, if you need to file an SR-22 or FR-44 kind, it will most likely requirement to remain in area for three years. The precise quantity of time might differ based on the driving infraction and also state where you live.

If that is the case, your state DMV will inform you. You will then need to notify your car insurance coverage company, and they will file the type with the DMV (insurance companies).Does My State Require an SR-22 After a DUI/DWI? The far better concern would certainly be to ask if your state is among minority that don't need an SR-22.

While the SR-22 itself may not set you back that much, your car insurance prices are practically guaranteed to rise due to the web traffic offense that triggered you to need one in the initial place in this case, a DUI/DWI. Some automobile insurance coverage companies do not supply vehicle insurance policy protection for drivers who need an SR-22.

The 6-Second Trick For 2022 Sr22 Insurance Florida (9 Reasons Why You May Need ...

The time period for the SR-22 can additionally start over if you allow your vehicle insurance coverage gap. sr-22. It's important to make certain you maintain up with your auto insurance repayments. The SR-22 and Ignition Interlock Gadgets, While being convicted of drunk driving, or being called for to have an SR-22 on data with the state may raise your auto insurance coverage prices, it is totally possible that telling your insurer about your ignition interlock device (IID) can decrease your rates somewhat, compared to someone in the exact same scenarios that does not have an IID installed.

ALCOLOCK Is With You when traveling Back, While ALCOLOCK is not an insurance coverage firm, we make it our organization to learn about things that influence our clients, like the SR-22 demand. We stay up to date on the drunk driving and also ignition interlock tool regulations throughout the nation so that we can supply you with the very best service feasible - sr22 coverage.

https://www.youtube.com/embed/Mj2O_bHJczc

We provide rapid as well as very easy installation, as well as our rates are among one of the most economical in the industry.